Social Security Facts

Max Sawicky of the Economic Policy Institute has compiled a useful bibliography of sources concerning Social Security reform, both pros and cons. Perhaps the most useful is a brief article published by the Center for Economic and Policy Research, authored by Dean Baker and David Rosnick. They explain why the proposal to privatize a portion of Social Security is a bad idea because it is based on two false premises: (1) that Social Security is in dire trouble, or will be in three or four decades, and (2) that the benefits of privatization will outweigh the benefits under the current structure.

Against the first premise, they write:

Notice that these are the projections of the Social Security Administration and the Congressional Budget Office. Notice also that the adjustment to be experienced between 2042 and 2052 is not all that severe and can be corrected by a few minor adjustments in benefits and taxes.

Next, they argue that the benefits of privatization are a chimera.

So to summarize, Social Security is NOT in dire trouble, and the benefits of privatization do NOT outweigh its costs. What does it take to get the media to understand that all of this rhetoric by the Bush administration about "saving" Social Security is really about destroying it? Republicans will not be happy until they have dismantled the New Deal entirely.

Against the first premise, they write:

According to the Social Security trustees report, the standard basis for analyzing Social Security, the program can pay all benefits through the year 2042, with no changes whatsoever. Even after 2042 the program would always be able to pay retirees a higher benefit (in today's dollars) than what current retirees receive. The assessment of the non-partisan Congressional Budget Office is that Social Security is even stronger. It projects that Social Security can pay all benefits through the year 2052 with no changes whatsoever. By either measure, Social Security is more financially sound today than it has been throughout most of its 69-year history.And they offer the following graph to display their point.

Notice that these are the projections of the Social Security Administration and the Congressional Budget Office. Notice also that the adjustment to be experienced between 2042 and 2052 is not all that severe and can be corrected by a few minor adjustments in benefits and taxes.

Next, they argue that the benefits of privatization are a chimera.

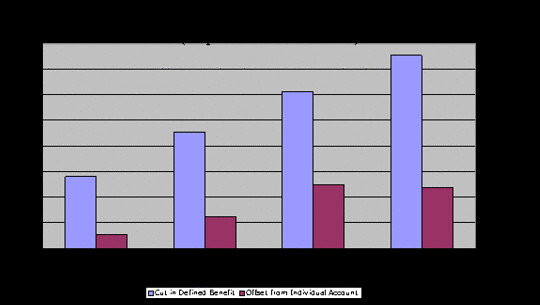

The proposal that President Bush is using as the basis for his plan phases in cuts over time. A worker who is 45 today can expect to see a cut in guaranteed benefits of around 15 percent. A worker who is age 35 can expect to see a cut in the guaranteed benefit of approximately 25 percent. A 15 year old who is just entering the work force can expect a benefit cut of close to 40 percent. For a 15 year old, this cut would mean a loss of close to $160,000 in Social Security benefits over the course of their retirement.They offer the following graph to illustrate these calculations. (The blue bars denote the cut in benefit levels; the red, the offset by private savings accounts.)

Private accounts will allow workers to earn back only a small fraction of this amount. For example, a 15 year-old can expect to make back approximately $50,000 from the $160,000 cut with the earnings on a private account. If this worker retires when the market is in a slump, then it could make their loss even bigger.

So to summarize, Social Security is NOT in dire trouble, and the benefits of privatization do NOT outweigh its costs. What does it take to get the media to understand that all of this rhetoric by the Bush administration about "saving" Social Security is really about destroying it? Republicans will not be happy until they have dismantled the New Deal entirely.

0 Comments:

Post a Comment

<< Home