Monday, February 28, 2005

Risk in American Life

A broad array of protections that families once depended on to shield them from economic turmoil — stable jobs, widely available health coverage, guaranteed pensions, short unemployment spells, long-lasting unemployment benefits and well-funded job training programs — have been scaled back or have vanished altogether.

...Under the banner of the "Ownership Society," the president has proposed a series of new, tax-break-heavy accounts to let families pay for their own retirements, healthcare and job training. He also has called for partially replacing the biggest of the government's protective programs — Social Security — with privately held stock and bond accounts.

Such arrangements might help people build up their personal assets. But the approach also would expose them to even more economic risk than they've already taken on.

...In the early 1970s, the inflation-adjusted incomes of most families in the middle of the economic spectrum bobbed up and down no more than about $6,500 a year, according to statistics generated by the Los Angeles Times in cooperation with researchers at several major universities. These days, those fluctuations have nearly doubled to as much as $13,500, the newspaper's analysis shows.

...Government used to provide substantial help in coping with joblessness. In the mid-1970s, jobless workers could collect up to 15 months of unemployment compensation. By last December, Congress had pared the program to just six months. Additionally, federal legislation in 1978 and 1986 effectively reduced the value of benefits by making them taxable. And state eligibility restrictions imposed in the late 1970s and early '80s shrank the fraction of the workforce entitled to collect benefits from about one-half to a little more than one-third. Of the 8 million people who were unemployed last month, only 2.9 million were collecting benefits.

The minimum wage was once the government's chief means of ensuring that "work pays" — that those willing to head to a job each day would make enough to live on. For decades, Democratic and Republican administrations alike maintained the minimum wage at about half of average hourly earnings in the U.S. But starting in the early 1980s, the minimum wage was allowed to slip. At $5.15, it is now only one-third of average hourly earnings, its lowest level in 50 years.

Washington once sought to help people adjust to global competition, industrial restructuring and technological change by offering job training. Twenty-five years ago, the federal government spent $27.3 billion annually (in 2003 dollars) through the Comprehensive Employment and Training Act, or CETA. Even if one doesn't count CETA's "public service" jobs, which were widely criticized as boondoggles, it was still spending $17.1 billion. By contrast, the government now spends about $4.4 billion on CETA's successor, the Workforce Investment Act. "It's largely a place holder," said Anthony P. Carnevale, an authority on education and training who was appointed to major commissions by presidents Reagan and Clinton. "It gives politicians something to point to but doesn't do much good."

Welfare was created to protect poor women and children, but by the late 1970s a growing chorus of analysts complained that the system had backfired by fostering a culture of dependency. In 1996, President Clinton and a Republican-controlled Congress approved a "work first" law that has cut welfare rolls by one-half and reduced inflation-adjusted welfare spending by at least one-third, or about $10 billion a year. On balance, the changes appear to have benefited people who can find jobs and hold them. But those who can't work or have lost their jobs can often find themselves in far worse shape. Twenty-five years ago in California, a mother of two who depended on welfare collected about $15,000 in cash assistance and food stamps. By last year, a woman in the same circumstances brought in $3,300 less, in inflation-adjusted terms.

...Twenty-five years ago, almost 40% of the nation's private full-time workforce was covered by traditional pensions, under which the employer bears the risks and pays the benefits. That number has fallen to 20%. In the place of pensions have come defined-contribution plans such as 401(k)s, under which an employer may kick in some funds — typically about half what would have been spent previously — but employees alone bear the burden of ensuring that they have enough money to retire on.

A similar shift is underway in health insurance. As recently as 1987, employers provided health coverage for 70% of the nation's working-age population, according to the Employee Benefit Research Institute in Washington. By last year, that had dropped to 63%. The change translates into nearly 18 million people who would have been covered under the old system scrambling to make their own arrangements. What's more, even when employers continue coverage, they increasingly push more of the costs onto employees. Since 2000 alone, employers have raised the premiums their workers must pay by an average of 50%, or about $1,000 a family, according to a recently released study by the Kaiser Family Foundation and the Health Research and Educational Trust.

When it comes to job security, employers have largely broken the bond they had with workers. A late 1980s study by the Conference Board, a business research group, found that 56% of major corporations surveyed agreed that "employees who are loyal to the company and further its business goals deserve an assurance of continued employment." A decade later, that number dropped to just 6%.

As a result, people are increasingly likely to be bounced from their jobs, with ever more severe financial consequences. In 1978, middle-aged men could expect to be with the same employer for 11 years, according to Bureau of Labor Statistics data. That's now down to about 7.5 years. Since the 1970s, the average length of an unemployment spell has risen by 50% to almost 20 weeks. The economic damage done when someone is laid off and his or her job is eliminated also has grown — even for those with college degrees. Princeton University economist Henry S. Farber recently found that college graduates laid off in the early 1980s suffered a 10% decline in income through a combination of forgone pay hikes from the old job and lower wages once back to work. By last year, laid-off college grads were taking a far bigger hit of 30%.

...Risk management tools help health insurers tailor coverage so that they avoid people apt to file lots of claims — or charge them more. Credit card issuers have figured out how to target those most likely to carry large balances and yet still manage to pay. Consultants devise variable pay schemes and flexible work schedules that let companies increase output while minimizing their risk of being stuck with unneeded employees.

...Although the overall economy has become steadier — settling into a pattern of long swells of growth followed by relatively gentle dips — the incomes of working people have been beset by ever-larger fluctuations. Looked at in this way, "we haven't reduced economic risks" at all, said Harvard economist Martin L. Weitzman. "We've simply redistributed them from the economy as a whole to individual households."

...Today, more than 70% of mothers work outside the home, compared with less than 40% in the 1970s. Although women's arrival in the full-time workforce has been driven by forces as disparate as feminism and the triumph of brain jobs over brawn, their influx could hardly have come at a better time for millions of working families. It has provided households with the insurance of a second wage earner in case anything happens to the first.

...The traditional measure of household debt — calculated as a percentage of a family's after-tax income — has climbed from 62% a quarter century ago to almost 120%, according to Federal Reserve statistics. Much of that increase is from the rush of mortgage lending during the last decade. But non-mortgage debt, including credit cards and auto loans, also has risen, from 15% to almost 24% of after-tax income.

...The borrowing boom has already produced one disturbing trend — a sixfold increase in personal bankruptcies since 1980. Bankruptcy filings reached a record 1.625 million last year and were up again through March of this year. Two decades ago, they totaled 288,000.

...Over the last quarter of a century, many safeguards that people once counted on to shield them from financial harm have been weakened or completely lost. These include formal protections such as guaranteed corporate pensions and state and federal unemployment benefits. And they include informal ones, like the loyalty that employers once showed their workers by offering secure jobs with relatively little prospect of long-term layoff. Other cushions that families like the Ryans have relied on, such as the financial stability that comes with a college education, also have eroded.

...Twenty-five years ago, college graduates not only made higher wages than less educated Americans but also enjoyed more income stability. Starting in the late 1970s, however, college-educated families began to experience increasingly large swings in their annual incomes as white-collar workers found themselves whipsawed by corporate downsizing.

The Times' statistics show that for a period in the mid-1990s — about the time that John was fired — the income volatility of college-educated families actually jumped above that of households lacking someone with a college degree.

Critique and Complaint

Still, there is a fine line between a critique of complaining and merely complaining about complaining. Furthermore, any critique of complaining implicitly legitimizes the value of criticism, and the spirit of critique arises out of the prophetic tradition which targets the systemic distortions of justice and truth in society in order to promote reform. This form of criticism is vital for a society to regulate its moral health. This is a distinction which must always be kept in mind when addressing the "malaise" of complaining in order that the message not become a justification for an unjust and dishonest status quo.

So what is today's specific critique? We find it in Peter G. Gosselin's three-part series in the LA Times about the phenomenon of increasing risk in contemporary life. For some background, see here and here. This is the introduction to the series which examines the "American paradox":

Why so many families report being financially less secure even as the nation has grown more prosperous. The answer lies in a quarter-century-long shift of economic risks from the broad shoulders of business and government to the backs of working families. Safety nets that once protected Americans from economic turbulence — safeguards like unemployment compensation and employer loyalty — have eroded or vanished. Families are more vulnerable to sudden shifts in the economy than any time since the Great Depression. The result is a daunting "New Deal" for many working Americans — one that compels them to cope, largely on their own, with financial forces far beyond their control.

Sunday, February 27, 2005

Phase-Out Plan Being Phased Out

The story was much the same throughout the country, as Republicans - some already skittish over Mr. Bush's plan - spent the week trying to assuage nervous constituents. Instead of building support for Mr. Bush's proposal to allow younger workers to divert payroll taxes into private retirement accounts, some of the events turned into fractious gripe sessions and others did not go nearly as well as their hosts had hoped.In a Post article about a possible compromise position, David Gergen opines that such an outcome seems doubtful. I hope he's right.

..."We've yet to find one where there was an enthusiastic reception," said John Rother, the group's policy director. "The most positive reception people are getting is lots of questions, and there's significant skepticism. This is proving to be a tough sell, and our polling suggests that the more people know, the harder the sell."

"Why would they put their head in that noose?" he asked. As long as Republicans are opposed to any tax increases and Democrats are opposed to any benefit cuts, "I don't see a lot of wiggle room" for fashioning a bargain.

Given the poor prospects for victory, Gergen said, Bush's best option might be "a preemptive strategy that allows him to dump out of this and move toward a pathway to a new solution."

Thursday, February 24, 2005

Falling Dollar

See here for background on our "lemming dollars" as they are poised on the precipice."Given the number of people who have refinanced their homes with floating-rate mortgages, the falling dollar is a kind of sword of Damocles, getting closer and closer to their heads," Mr. Rothkopf [a former Clinton Commerce Department official] said. "And with any kind of sudden market disruption - caused by anything from a terror attack to signs that a big country has gotten queasy about buying dollars - the bubble could burst in a very unpleasant way."

Why is that sword getting closer? Because global markets are realizing that we have two major vulnerabilities that this administration doesn't want to address: We are importing too much oil, so the dollar's strength is being sapped as oil prices continue to rise. And we are importing too much capital, because we are saving too little and spending too much, as both a society and a government.

"When people ask what we are doing about these twin vulnerabilities, they have a hard time coming up with an answer," noted Robert Hormats, the vice chairman of Goldman Sachs International. "There is no energy policy and no real effort to reduce our voracious demand of foreign capital. The U.S. pulled in 80 percent of total world savings last year [largely to finance our consumption]." That's a big reason why some "43 percent of all U.S. Treasury bills, notes and bonds are now held by foreigners," Mr. Hormats said.

Hail Alma Mater

I just learned that he attended the college where I teach, Thiel College. Fortunately, he transferred and graduated elsewhere, but he does have a connection here. We all feel especially proud of our former students today.

Tuesday, February 22, 2005

Health Update

Monday, February 21, 2005

Smiley People

“Happy smiley people cheer others up around them, which in turn makes them more stable and less prone to depression or divorce than those who faked it in their yearbooks.”The researchers, however, do not explain how much ressentiment was created by the presence of these smiley overlords.

Friday, February 18, 2005

Greenspan Under Attack

Here's the Greenspan timeline:

* 1983: Recommended raising payroll taxes far above the amount required to fund Social Security. Since payroll taxes are capped (at $87,000 currently), this was, by definition, an increase that primarily hit the poor and middle class.

* 2001: Enthusiastically endorsed a tax cut aimed primarily at people who earn over $200,000.

* 2003: Ditto.

* 2004: Told Congress that due to persistent deficits Social Security benefits need to be cut.

So: raise payroll taxes on the middle class to create a surplus, then cut taxes on the rich to wipe out the surplus and create a deficit, and then sorrowfully announce that the resulting deficits mean that the Social Security benefits already paid for by the middle class need to be cut.

Wednesday, February 16, 2005

Madame de Pompadour's Prophecy

After reading Paul Krugman's article of Feb. 11, I looked up the OMB deficit projections over the next ten years, and it occurred to me that her words could be the Bush-Cheney motto: "After us, the flood."

In discussing the "class-war budget" recently proposed by the Bush administration, Paul Krugman writes:

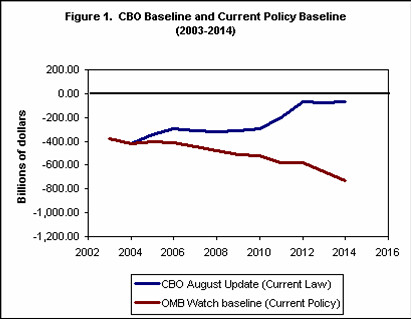

Here's a comparison: the Bush budget proposal would cut domestic discretionary spending, adjusted for inflation, by 16 percent over the next five years. That would mean savage cuts in education, health care, veterans' benefits and environmental protection. Yet these cuts would save only about $66 billion per year, about one-sixth of the budget deficit.And here is the OMB projection (the red line):

On the other side, a rollback of Mr. Bush's cuts in tax rates for high-income brackets, on capital gains and on dividend income would yield more than $120 billion per year in extra revenue - eliminating almost a third of the budget deficit - yet have hardly any effect on middle-income families. (Estimates from the Tax Policy Center of the Urban Institute and the Brookings Institution show that such a rollback would cost families with incomes between $25,000 and $80,000 an average of $156.)

Why, then, shouldn't a rollback of high-end tax cuts be on the table?

Tuesday, February 15, 2005

Flu

First, the wife got it on her birthday, then the husband a day later. The nearly-one-year-old has it too. Compared to her normal behavior, she is remarkably logy. The mother-grandmother combination took her to the doctor this morning in order to be told that she needs rest and fluids. She is resting comfortably now. The dog is fine, if a little edgy.

Hegel's Moment of Despair

In 1821, Hegel concluded his series of lectures on the philosophy of religion with a remark that he did not repeat in the later versions of these lectures in 1824, 1827, and 1831. Still, this remark was in the original manuscript of the lectures, and it is the very last paragraph. Thus, it seems noteworthy even if it does not survive the redactions of later years. Here it is (from the Hodgson three-volume edition of the Lectures on the Philosophy of Religion, vol. 3, p. 162):

Religion must take refuge in philosophy. For the theologians of the present day, the world is a passing away into subjective reflection because it has as its form merely the externality of contingent occurrence. But philosophy, as we have said, is also partial: it forms an isolated order of priests--a sanctuary--who are untroubled about how it goes with the world, who need not mix with it, and whose work is to preserve this possession of truth. How things turn out in the world is not our affair.The first part about theology is to be expected. As he perceived it in his era, theology had been so thoroughly co-opted by rationalism that it had removed itself from any real engagement with the world and the substantive issues of theological doctrine. Hegel saw this especially in Kant's rational theology--the epitome of subjective reflection that dismisses the world's religions and their histories, symbols, and doctrines as so much cognitive pathology and pith, but this problem was also evident in Jacobi's resolute defiance of "reason," which for him leads ineluctably to his distorted version of Spinozism tantamount to fatalism and atheism. Schleiermacher's theology seemed to be no solution but only a mixture of these two influences by virtue of a transcendental deduction (there's the Kantian rationalism) of religious feeling (there's Jacobi's anti-rationalism).

But the last part represents a stunning confession from the philosopher whose project from his earliest writings (such as the Early Theological Writings and the Phenomenology) had been to resolve the lasting cultural ills that plague the modern world--dualisms that urgently call for reconciliation: first and foremost, the dualism of the divine and the world; second, humanity and nature; third, the individual and the community; fourth, thought and reality. And here in this final sentence, all of these aspirations seem to come crashing down on the rocks of despair: philosophers are an “order of priests” who do not mix with the world but only preserve their private possession of truth. How things turn out in the world is not the business of philosophers! First of all, what sort of Verstand-thinking is this, presupposing a philosopher/world dualism such as this? Furthermore, no wonder the Young Hegelians felt pressed to part ways with their master.

Thursday, February 10, 2005

Homo Sacer in the U.S.

The sacred man is the one whom the people have judged on account of a crime. It is not permitted to sacrifice this man, yet he who kills him will not be condemned for homocide.In other words, one who has been deemed "bad" or "impure" is no longer protected under Roman law. He has lost his sovereignty.

Mayer's article is about the U.S. government's routine use of torture as an interrogation technique--either directly or through "extraordinary rendition," i.e., "rendering" suspects to other countries where such practices will be employed on behalf of the U.S. At one point in the article, John Yoo is introduced and discussed in relation to his advisory role on U.S. torture policy. He is quoted in the article as saying:

“Why is it so hard for people to understand that there is a category of behavior not covered by the legal system?” he said. “What were pirates? They weren’t fighting on behalf of any nation. What were slave traders? Historically, there were people so bad that they were not given protection of the laws. There were no specific provisions for their trial, or imprisonment. If you were an illegal combatant, you didn’t deserve the protection of the laws of war.”Here we have homo sacer reappearing in U.S. law. Later on Mayer reports Yoo's view as follows:

Yoo also argued that the Constitution granted the President plenary powers to override the U.N. Convention Against Torture when he is acting in the nation’s defense—a position that has drawn dissent from many scholars. As Yoo saw it, Congress doesn’t have the power to “tie the President’s hands in regard to torture as an interrogation technique.” He continued, “It’s the core of the Commander-in-Chief function. They can’t prevent the President from ordering torture.”So it is a "core" function of the Commander-in-Chief to abuse his powers. A reminder of the Declaration of Independence is in order.

We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness. --That to secure these rights, Governments are instituted among Men, deriving their just powers from the consent of the governed, --That whenever any Form of Government becomes destructive of these ends, it is the Right of the People to alter or to abolish it, and to institute new Government, laying its foundation on such principles and organizing its powers in such form, as to them shall seem most likely to effect their Safety and Happiness.Such revolutionary action should not be taken lightly, but for citizens whose rights are being denied by an abusive commander-in-chief "it is their right, it is their duty, to throw off such Government, and to provide new Guards for their future security." Does this apply to our situation?

Tuesday, February 08, 2005

Acosmism

Thus, when Spinoza claims that omnis determinatio est negatio (everthing finite is a limitation or negation of the One, i.e., of absolute substance), Parmenides would claim that all of the negations which define the existence of concrete beings are in fact illusory. Thus, Spinoza cannot be accused of atheism so much as acosmism. It is not clear that any of the finite distinctions which comprise the cosmos can exist because they rely upon nonbeing (negation) for their being. Thus, it is not that God does not "exist" (it is better to say "is not actual" because existence is already ensnared in this problem of negative determination), it is the world that is illusory.

Close Commerce and Energy

With the unveiling of the Bush budget, the predictable debate will commence. The elephant will suddenly attempt to cross-dress as a deficit hawk after creating the problem with tax cuts for their donors. The left will justifiably decry the savaging [of] programs that assist the poor. And the center will cast a pox on both of their houses for fiscal hypocrisy.

The Moose suggests a third way for the donkey. Democrats should move to the right of the Bushies on deficit reduction. Embrace the spirit of the betrayed Republican Revolution of 1994 and call for the closing of Federal departments. The Moose suggests two Federal behemoths to put on the chopping block - the Departments of Commerce and Energy.

Commerce and Energy are the targets because they are primarily conduits for corporate welfare. Along with these two agencies, the donkey should launch an "end corporate welfare as we know it" campaign. Then, Democrats can hold news conferences at the Heritage Foundation and the Cato Institute and urge Republicans to join them in this great cause to cut welfare for the comfortable.

Friday, February 04, 2005

Phasing Out Social Security

The Bush plan involves three phases:

1. Default on the General Fund's debt to the Social Security Trust Fund.

2. Benefit cuts.

3. Allow workers to divert 1/3 of their payroll taxes into a "personal," formerly known as "private," account.

Let's take each of these phases in turn. It will turn out that there are at least two ways to describe them, i.e., two equivalent ways though they may have a different rhetorical effect. These alternative descriptions were the source of some controversy regarding Jonathan Weisman's Washington Post article. See Brad DeLong for an extensive account of that matter, but I will try to give the gist of it here along with the main points of the Bush plan.

So the first phase is to default on the General Fund's debt to the Social Security Trust Fund. A little background is in order here. The Social Security Trust Fund was created in the early 1980s by Alan Greenspan et al. as a means of dealing with the retirement of baby boomers thirty years later. Essentially, the plan was to have workers pay in more than their fair share for the next twenty years so that there would be a Trust Fund from which to draw benefits once the income of payroll taxes decreased after their retirement. At that point, the upper income levels would have to pick up the slack after years of low payments. (Part of the reason for this plan was supply-side economics: allow the wealthy to invest their funds during the rocky years of the early 1980s, and collect their share later when the economy would presumably be booming.)

At this point, the fact is that all of the extra money coming into the Social Security Trust Fund has actually been "borrowed" by the U.S. government and spent as part of the General Fund. The Social Security Trust Fund really amounts to U.S. Treasury promisory notes. As Josh Marshall notes, the question we need to be asking is whether the U.S. government plans to default on these promisory notes. Marshall writes:

The Social Security Trust Fund now has accumulated roughly $1.8 trillion worth of US Treasury bonds. That total debt of the United States government is, if memory serves, just over $7 trillion. US Treasury bonds are owned by Americans, foreigners, individuals, pension funds, everybody under the sun. Most of the president's personal wealth appears to be tied up in them. They're universally considered to be the safest investment in the world. George W. Bush is the President of the United States. So the question is to him. Are the Treasury notes in the Social Security Trust Fund backed by the full faith and credit of the United States every bit as much as the bonds everyone else owns?It seems clear from the rest of the "plan" we are hearing that the President can have nothing else in mind but defaulting on these Treasury notes, and all of the references to 2018 as a moment of crisis would indicate this because that is the date at which these notes would begin to be redeemed. There is no reason to describe that year with words of caution and trepidation unless it marks the ominous moment of failure to redeem these promisory notes. Of course, the possibility of defaulting on this debt looks like a gold mine with which to rescue the General Fund from its current state of massive deficit. This way the tax cuts can justifiably be made permanent, reform of the A.M.T. can go forward, and the enormous cost of the Iraq War can be afforded. So that's phase one: default on the General Fund's debt to the Social Security Trust Fund.

Phase two is a set of benefit cuts. The only problem with defaulting on the Social Security Trust Fund is that there will not be nearly enough money coming in from payroll taxes to pay the current benefits. Thus, benefits will have to be cut in order to balance the cash flow. How much exactly is hard to predict, but by 30% or more does not seem out of the question.

Phase three is a program of optional savings accounts. A citizen can opt to divert one-third of her or his payroll taxes into a private account. This account will then accrue interest according to the whims of the market and its vehicle of investment. Meanwhile, the government will still have to pay benefits to the nation's seniors and so will make up for the loss of this revenue by borrowing the money at a 3 percent interest rate. When this citizen retires, her or his benefits will have to be cut one more time, in addition to what was cut in phase two for everyone across the board. That is, upon retirement anyone with a private account will have her or his benefits cut by the amount that was diverted into a private account over the years plus 3 percent interest. Assuming my account earns 3 percent interest, I come out even. Any higher earnings are my extra savings, but anything lower and I simply lose. That's the risk of the market.

Another way to describe phase three is to say that the government is loaning me the money for my private account in the first place. When I retire, I pay back the loan with 3 percent interest and keep any profits above that. Phase three under this second description is identical to the phase three under the first description. In the former description, citizens who choose private accounts get two cuts in benefits, while the latter description makes their accounts an elaborate government loan rather than a truly personal account.

In the end, unless you are very wealthy to begin with, the cuts in benefits in phase two will do the most damage, and the potential earnings in phase three--earnings that rise above the rate of 3 percent of one's (fairly small) private account--could never outstrip those losses. For the very wealthy, such tax-free accounts could provide another kind of tax shelter for their assets, but for most people such savings would be minimal compared to the diminished earnings caused in phase two.

Thursday, February 03, 2005

Emotional Politics

We could have held these just-past elections in June of 2003. We would--in the fresh glow of the overthrow of Saddam Hussein--have gotten a more pro-US Iraqi assembly than we have now. But we didn't. We have dinked around for nineteen months. We haven't spent it rebuilding Iraq. We haven't spent it maintaining civil order. We have demonstrated that 150,000 non-Arabic speaking American soldiers cannot suppress an insurgency. And over the past nineteen months we have lost 1300 dead and 7000 permanently maimed.After all of the self-praising in connection to the purported success of the recent elections, Kevin Drum points out that "you'd hardly even know that the only reason we just had elections in Iraq was because of a UN-brokered deal with the country's most prominent cleric — opposed by the Bush administration for over a year until they were finally forced to give in and agree to it."

For what? The first 100 of our war dead died to overthrow a brutal dictator whom some in the Bush administration appear to have genuinely (but falsely) thought to be on the verge of developing nuclear weapons. The next 1300 died... for what, exactly?

In the end, reading Hegel proved to be more uplifting and less maddening. At times like these, we need to hear Hegel demolish the pretensions of Jacobi who claimed that our highest human aspirations can only be intuited immediately but not thought rationally. Nay, we are "thinking spirits."

Wednesday, February 02, 2005

Tuesday, February 01, 2005

Privatizers' Catch-22

They [privatizers] can rescue their happy vision for stock returns by claiming that the Social Security actuaries are vastly underestimating future economic growth. But in that case, we don't need to worry about Social Security's future: if the economy grows fast enough to generate a rate of return that makes privatization work, it will also yield a bonanza of payroll tax revenue that will keep the current system sound for generations to come.This is really all anyone needs to know regarding the whole issue. It turns out we are comparing apples and oranges when we imagine the outstanding conditions necessary for privatization schemes to work--these are the apples--and the dismal conditions necessary for Social Security to fail--those are the oranges. The future can't be both apples and oranges at the same time; there's an Aristotelian principle of non-contradiction to be met here. It is simply not logically possible for the economy to be both an apple and a non-apple for next 75 years.Alternatively, privatizers can unhappily admit that future stock returns will be much lower than they have been claiming. But without those high returns, the arithmetic of their schemes collapses.

It really is that stark: any growth projection that would permit the stock returns the privatizers need to make their schemes work would put Social Security solidly in the black.