Standard Economics

Brad DeLong quotes with disgust this article in the Washington Post because the reporter (Jonathan Weisman) does not know the basic economics that he should in order to be reporting on tax reform. Instead, he simply parrots the talking points of the Republicans as they contemplate eliminating the tax deduction for employer-provided health insurance:

I can never understand why this one does not get more attention. As the number of uninsured increase (at a rapid rate since President Bush has been in office, in fact), most of the reporting has been about the effects on those directly involved (which, admittedly, is brutal), but not on the aggregate effect on the system as a whole. Clearly, more insured people would care if they understood that this trend has real, quantifiable effects on them. Ask not for whom the bell tolls, it tolls for thee, indeed.

I know about this directly. My college insures its employees through a group plan which is hindered by the disproportionately aging population of the faculty and staff. We would be much better off if we were bargaining as a much larger group with greater dispersion, as has been discussed in joining with other colleges' plans in the area.

This is the only "standard economic principle" which might support the elimination of the tax deduction on employer-provided healthcare. We have also heard a lot about "frivolous lawsuits" in this regard. However, DeLong notes that this principle only works as a justification

Parts (a) and (b) were John Kerry's ideas; they are not the Bush administration's. And part (c) is not necessarily the case.

This seems like a good Republican principle. I have been on the lookout for similar kinds of issues--traditional Republican ideas forged during their years as outsiders in the Congress which can now be turned on them while they are in power. In general, any sort of argument tells the government to "get out of my business" is rhetorically effective in this regard.

If this could be quantified and verified with insurance accountants and actuaries, the specific costs that would inevitably be passed on to the consumers could then be calculated.

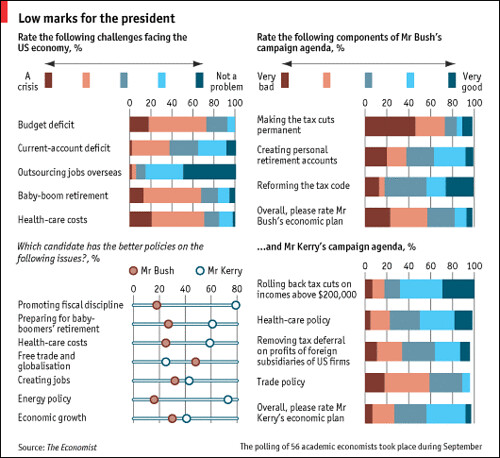

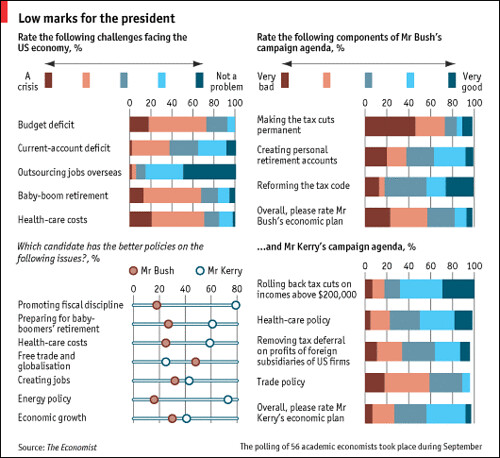

On the whole, then, there seem to be two lessons. Since ordinary newspaper reporters (even fairly smart ones) do not really know enough about economics (or nuclear weapons, or whatever), they should be wary of consuming the talking points of the party in power without checking with some independent economists in universities. By the way, when The Economist took a poll among economics professors, they found Mr. Bush's ideas to be regarded as significantly worse than John Kerry's. Here is their handy chart to compare the results of the survey for each candidate:

The second lesson is that the Bush administration is serious about making it more difficult for the average American to get and retain health insurance. Democrats need to frame their views in this light: we want to preserve and expand health care, not dismantle and destroy it. The same goes for Social Security.

In a speech yesterday at the American Enterprise Institute, N. Gregory Mankiw, chairman of the White House Council of Economic Advisers, spoke repeatedly of "standard economic theory," "textbook economic theory" and "scholarly literature in economics" to bolster his arguments.If Mankiw purports to be grappling with "standard economic theory," DeLong asks why he does not address the following five standard principles of economic theory concerning tax deductions for employer-provided health insurance:

1. Cost shifting: coverage for those who don't have health insurance is ultimately paid for by those who do, causing all kinds of financing and incentive problems. Thus there is very good reason to subsidize coverage to try to minimize the number of uninsured.

I can never understand why this one does not get more attention. As the number of uninsured increase (at a rapid rate since President Bush has been in office, in fact), most of the reporting has been about the effects on those directly involved (which, admittedly, is brutal), but not on the aggregate effect on the system as a whole. Clearly, more insured people would care if they understood that this trend has real, quantifiable effects on them. Ask not for whom the bell tolls, it tolls for thee, indeed.

2. Adverse selection: markets in which one party knows much more about the value of the deal than the other are markets that work badly. Health insurance markets work much better when what is insured is a group with statistically-predictable risks than an individual with idiosyncratic risks difficult for the insurer to discover.

I know about this directly. My college insures its employees through a group plan which is hindered by the disproportionately aging population of the faculty and staff. We would be much better off if we were bargaining as a much larger group with greater dispersion, as has been discussed in joining with other colleges' plans in the area.

3. Moral hazard: when insurance companies rather than patients bear the marginal costs of treatments, there is an incentive to overtreat--except where treatment has public-health external benefits, and except where the insurer has written the contract to control utilization.

This is the only "standard economic principle" which might support the elimination of the tax deduction on employer-provided healthcare. We have also heard a lot about "frivolous lawsuits" in this regard. However, DeLong notes that this principle only works as a justification

to the extent that (a) large tax preferences were retained for employer-sponsored catastrophic coverage, (b) large tax preferences were retained for appropriate preventive and public health-related care, and (c) insurers were not able to appropriately manage care and utilization in the first place.

Parts (a) and (b) were John Kerry's ideas; they are not the Bush administration's. And part (c) is not necessarily the case.

4. Coase theorem: Whenever informed and knowledgeable parties have reached agreement on the terms of a contract (i.e., comprehensive health insurance), do not presume that the government is doing anybody any favors by reaching in and monkeying with the contract terms.

This seems like a good Republican principle. I have been on the lookout for similar kinds of issues--traditional Republican ideas forged during their years as outsiders in the Congress which can now be turned on them while they are in power. In general, any sort of argument tells the government to "get out of my business" is rhetorically effective in this regard.

5. Transaction costs: pointless churning of industry structure can be very expensive indeed.

If this could be quantified and verified with insurance accountants and actuaries, the specific costs that would inevitably be passed on to the consumers could then be calculated.

On the whole, then, there seem to be two lessons. Since ordinary newspaper reporters (even fairly smart ones) do not really know enough about economics (or nuclear weapons, or whatever), they should be wary of consuming the talking points of the party in power without checking with some independent economists in universities. By the way, when The Economist took a poll among economics professors, they found Mr. Bush's ideas to be regarded as significantly worse than John Kerry's. Here is their handy chart to compare the results of the survey for each candidate:

The second lesson is that the Bush administration is serious about making it more difficult for the average American to get and retain health insurance. Democrats need to frame their views in this light: we want to preserve and expand health care, not dismantle and destroy it. The same goes for Social Security.

0 Comments:

Post a Comment

<< Home